- 4Closure Rescue Launches National Program to Help Homeowners Avoid Foreclosure

- Intel and Times of India Launch 'The Learning Curve' to Bridge Digital Trust Gap in Education

- Personal Online Reputation Management: Why It’s No Longer Optional

- Kronenbourg 1664 Blanc Brings a Taste of French Elegance to Karnataka

- Dr. Sandeep Marwah Honored in Edinburgh, Scotland for Setting Ten World Records in Media and Education

- Galgotias University Celebrates Its Achievement in QS World University Rankings 2026

- SAIMUN 2025 Welcomes 23 Nations and 26 Schools on One Global Platform

- Certified Softwash Solutions Celebrates 7 Years of Exterior Cleaning Excellence in Windsor-Essex

- Tranzlatex Launches as a Global Leader in Translation and Transcription Services

- Solaralm Partners with SolarEdge Solutions to Deliver High-Quality Solar Appointments Across the USA

- Shreekant Patil Led ESDP on Solar Entrepreneurship Organized by NIESBUD and Hosted by JSS Nashik

- West Bengal Cold Storage Association Voices Concerns over Potato Market Price & Loss to the Farmers & Cold Storage Industries

- Paige Anderson Unveils Stunning New Makeup Editorial Services

- Advik Releases New Windows Live Mail to PST Converter

- Pixel Web Solutions Expands DeFi Development Services to Accelerate Financial Decentralization

Mail to a Friend Mail to a Friend |

|

|

Continental Further Increases Earnings

Continental increased its earnings in the third quarter of 2024, as expected. In particular, the Automotive group sector made progress thanks to the measures taken to improve earnings, and it aims to make further gains in adjusted EBIT in the fourth quarter. As in the second quarter of 2024, the Tires group sector posted a good adjusted EBIT on the back of improved business in Europe, boosted not least by encouraging early sales of winter tires. Earnings in ContiTech, by contrast, were dented by continued weak industrial development in Europe and North America. Continental does not expect the industrial business to recover in the fourth quarter and is therefore adjusting its sales and earnings outlook for ContiTech. As a result, sales expectations have also been lowered for the Continental Group as a whole.

“We continue to drive Continental’s development – strategically and operationally, step by step. We are making our group sectors more agile and bringing them closer to the markets. Bolstered by the maturity they have built up over the years, they are now ready for greater independence. Automotive is on track to fulfill the requirements for a spin-off by the end of 2025. This spin-off is still being evaluated. Furthermore, the measures we have defined and implemented to improve earnings are having the desired effect. In the third quarter, for example, we increased our earnings both year-on-year and compared with the first two quarters of 2024. This was largely driven by price adjustments and disciplined cost management,” said Continental CEO Nikolai Setzer in Hanover on Monday, adding: “In this challenging year-end sprint, we aim to improve Automotive’s earnings even further.”

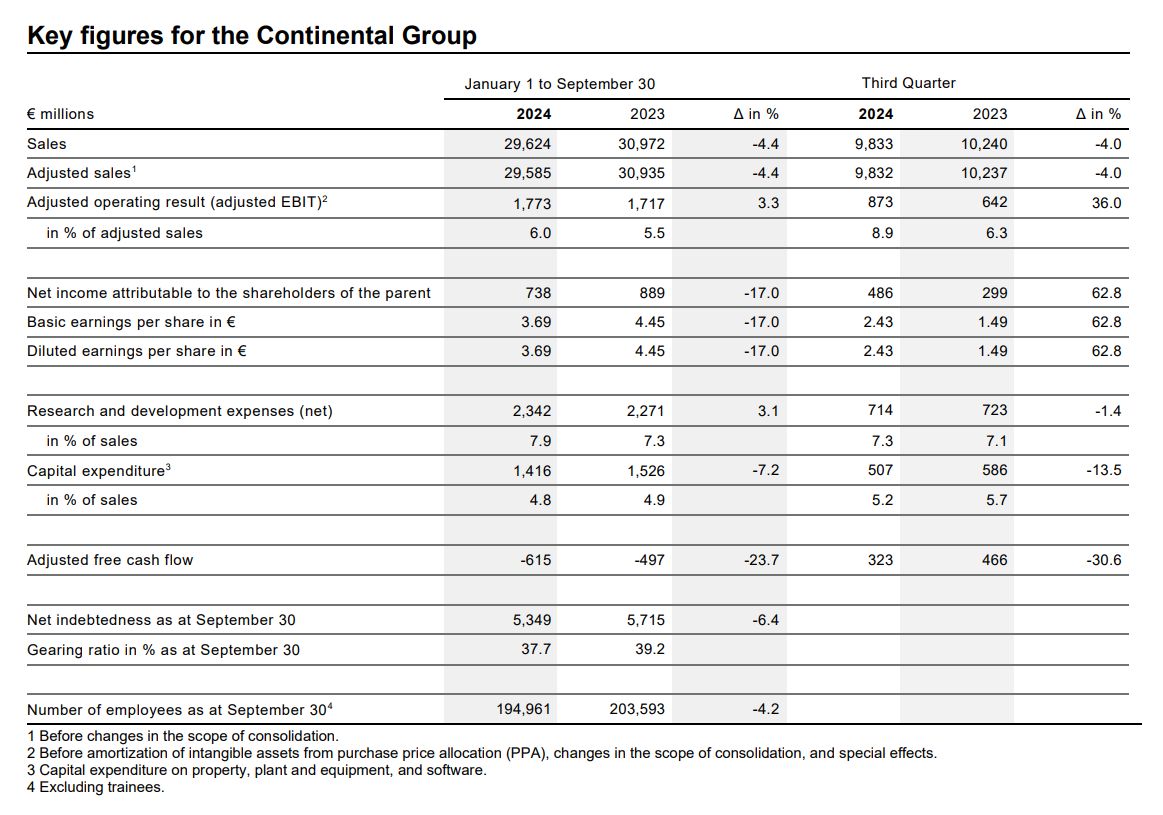

Adjusted operating result (adjusted EBIT) of €873 million

In the third quarter of 2024, Continental achieved consolidated sales of €9.8 billion (Q3 2023: €10.2 billion, -4.0 percent). Its adjusted operating result increased to €873 million (Q3 2023: €642 million, +36.0 percent), corresponding to an adjusted EBIT margin of 8.9 percent (Q3 2023: 6.3 percent).

Net income in the third quarter amounted to €486 million (Q3 2023: €299 million, +62.8 percent). Adjusted free cash flow was €323 million (Q3 2023: €466 million, -30.6 percent).

“We posted good results for the third quarter. In the Automotive group sector, we improved our earnings as announced. Faced with weak automotive production, we achieved this by reducing costs and adjusting prices. Tires is performing well in terms of profitability, with the winter tire business getting off to a good start. But ContiTech continues to contend with a weak industrial environment in Europe and North America. With this down phase lasting longer than expected, we are examining additional measures to deal with the economic situation,” said Continental CFO Olaf Schick, adding: “We have also reached an agreement with Vitesco Technologies on the allocation of investigation costs. The associated payment of €125 million by Vitesco Technologies had a positive impact on our net income and free cash flow in the third quarter, which we expect to continue to increase in the fourth quarter due to the seasonal nature of our business. The process of making our business with ContiTech products for the automotive industry independent is also progressing as planned. As announced, we will present this business area to potential buyers and partners in the fourth quarter of this year.”

Outlook for fiscal 2024

For 2024 as a whole, Continental expects the production of passenger cars and light commercial vehicles to decrease year-on-year. We expect demand in the tire-replacement business to pick up slightly in the second half of 2024 compared with the first six months, while the industrial business worldwide is expected to remain sluggish.

Based on the assumptions mentioned as well as current exchange rates, Continental has adjusted its outlook for fiscal 2024 as follows:

For the Continental Group, sales in the range of around €39.5 billion to €42.0 billion (previously: €40.0 billion to €42.5 billion) are expected, while the adjusted EBIT margin is expected to be around 6.0 to 7.0 percent.

For the ContiTech group sector, Continental expects sales of around €6.2 billion to €6.6 billion (previously: €6.6 billion to €7.0 billion) and an adjusted EBIT margin of around 5.8 to 6.3 percent (previously: 6.5 to 7.0 percent).

The tax rate is projected to be around 30 percent (previously: 27 percent). The higher calculated tax rate compared with the previous assumption is mainly due to the allocation of net income to the different countries in relation to comprehensive income. Tax charges that are not directly dependent on income also continue to have an effect. These include foreign (minimum) taxes with deviating bases of assessment as well as foreign withholding taxes that are not deductible in Germany.

Company :-PRHUB

User :- Lochan

Email :-lochan@prhub.com

Phone :-08022483008

Mobile:- 08022483008

Url :- https://www.prhub.com/

_(1)_thumb.jpg)