- Dev Technosys Launches Innovative eWallet App Development Solutions to Empower Businesses

- Tata Motors Re-Enters South Africa Market with Bold, Future-Ready Range of Passenger Vehicles

- DiGi MARK Launches Industry-Focused Digital Marketing Courses in Jabalpur

- Chetu Wins 2025 Silver Stevie® International Business Award® For Company Of The Year

- Government of Meghalaya partners with International Olympic Committee and Abhinav Bindra Foundation to launch Olympic Values Education Programme

- Bowman Rutledge Victoria Expands Services to Meet Growing Housing Demands

- Biotuff Unveils Stronger Eco-Friendly Bin Bags For 2025

- Medhavi Skills University Partners with BVG Group to Launch Industry-Integrated Education Programs in India

- DDi added more AI Agents to enhance Regulatory Strategy, Planning, and Project Actions

- Shyam Metalics Marks 79th Independence Day with Pan-India Celebrations and Sustainability Drive

- Blockchain Staffing Ninja Unveils New Website to Make Blockchain Hiring Smarter and Simpler

- FoxData Launches Advanced User Analytics Feature to Transform App Growth Strategies

- Vedaanta Senior Living Unveils #SecondInningsUnscripted Campaign on Senior Citizens Day

- Modern Public School, Shalimar Bagh Joins Delhi Government’s Month-Long Cleanliness Mission Led by CM Rekha Gupta

- 124th AAFT Festival of Short Digital Films Inaugurated by Filmmaker Muzaffar Ali at Marwah Studios

Mail to a Friend Mail to a Friend |

|

|

Continental Significantly Increases Earnings in Second Quarter

Continental ended the second quarter of 2024 in line with its expectations. As announced, the company significantly increased earnings in all three group sectors compared with the first quarter of this year. The technology company also posted much stronger earnings year-on-year. In the Automotive group sector, price adjustments and initial savings from cost-cutting measures had a particularly positive effect. The Tires group sector achieved good results thanks mainly to the strong tire-replacement business, especially in Europe. In a weak industrial market environment, ContiTech also benefited from price adjustments and strict cost discipline. Furthermore, Continental has adjusted its outlook due in large part to lower expected production of passenger cars and light commercial vehicles.

“As announced, we improved in all group sectors compared with the first quarter. We have made significant progress in Automotive and aim to improve even further in the coming quarters. Tires achieved good results, while ContiTech also performed well despite a still weak industrial environment. In the current challenging market environment, the improvements in earnings are mainly due to the measures we have taken in the group sectors,” said Continental CEO Nikolai Setzer in Hanover on Wednesday.

?

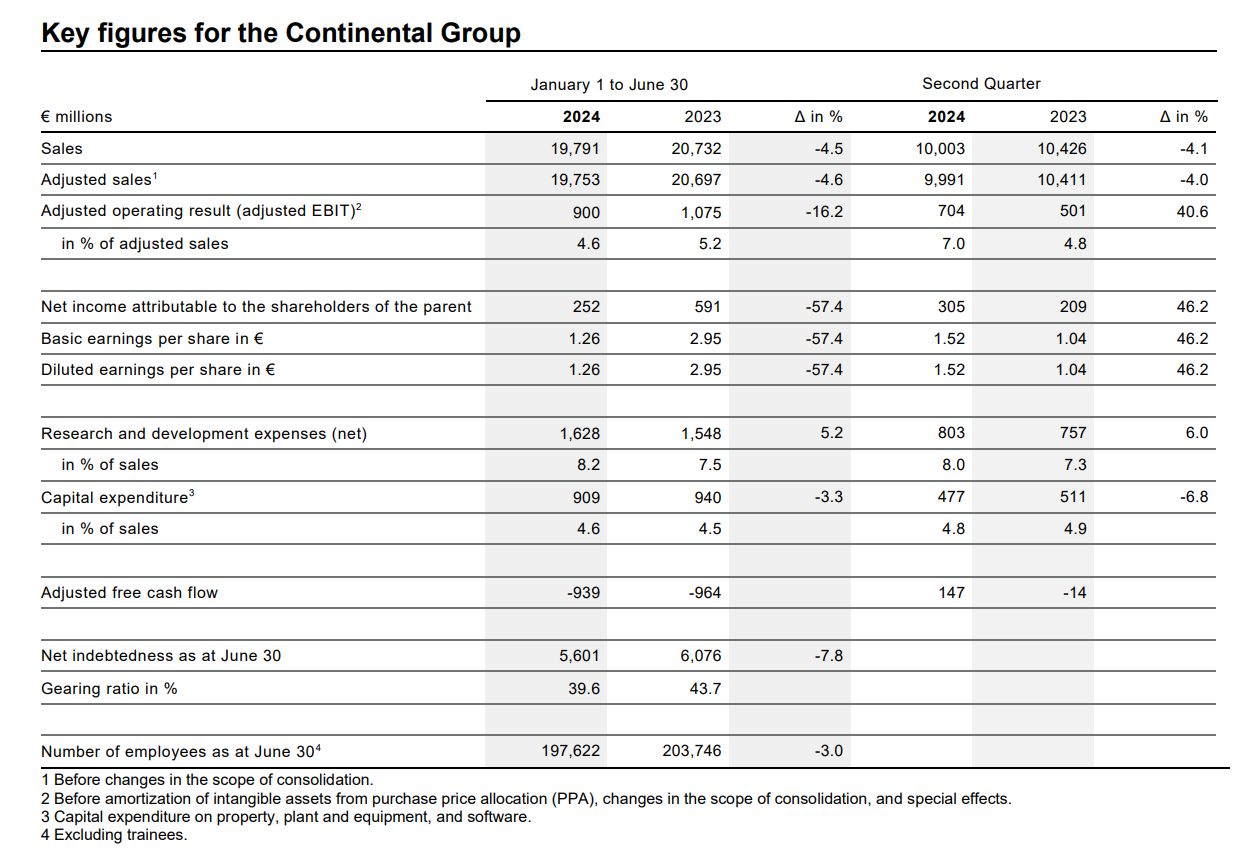

Adjusted operating result (adjusted EBIT) of €704 million

In the second quarter of 2024, Continental achieved consolidated sales of €10.0 billion (Q2 2023: €10.4 billion, -4.1 percent). Its adjusted operating result increased to €704 million (Q2 2023: €501 million, +40.6 percent), corresponding to an adjusted EBIT margin of 7.0 percent (Q2 2023: 4.8 percent).

Net income in the second quarter amounted to €305 million (Q2 2023: €209 million,

+46.2 percent). Adjusted free cash flow was €147 million (Q2 2023: -€14 million).

“The measures we have adopted to reduce costs and our commitment to implementing them effectively are starting to pay off and helped us to improve significantly compared with the first quarter. We will not let up in the second half of the year and will continue to work hard to achieve the financial targets we have set ourselves,” said Continental CFO Olaf Schick.

Weak automotive production in Europe

The global production of passenger cars and light commercial vehicles in the second quarter of 2024 was roughly on par with the previous year, falling marginally by around 1 percent year-on-year to 22.1 million units (Q2 2023: 22.3 million units).

At around 4.3 million units, vehicle production in Europe from April to June 2024 was significantly lower than the prior-year period (-6 percent). In North America, production rose slightly to around 4.2 million vehicles (+2 percent). China saw gains of roughly 5 percent, producing

around 7.0 million vehicles in the second quarter of 2024.

Market outlook and forecast for fiscal 2024 adjusted

For the current fiscal year, Continental expects the production of passenger cars and light commercial vehicles to develop by -3 to -1 percent year-on-year (previously: -1 to +1 percent).

This is due to in large part to the European market, where Continental forecasts a slowdown of

-6 to -4 percent (previously: -3 to -1 percent). The technology company expects the North American market to develop by -1 to +2 percent (previously: 0 to +3 percent) in the tire-replacement business.

Given the expected market trends described above, Continental has adjusted its outlook for the current fiscal year.

Continental now expects consolidated sales of around €40.0 billion to €42.5 billion (previously: around €41.0 billion to €44.0 billion) and still expects an adjusted EBIT margin of around 6.0 to 7.0 percent.

For the Automotive group sector, Continental expects sales of around €19.5 billion to €21.0 billion (previously: around €20.0 billion to €22.0 billion) and an adjusted EBIT margin of around 2.5 to 3.5 percent (previously: 3.0 percent to 4.0 percent).

For the Tires group sector, Continental now anticipates sales of around €13.5 billion

to €14.5 billion (previously: around €14.0 billion to €15.0 billion) and still expects an adjusted EBIT margin of around 13.0 to 14.0 percent.

For the ContiTech group sector, Continental still expects sales of around €6.6 billion to €7.0 billion and now expects an adjusted EBIT margin of around 6.5 to 7.0 percent (previously:

around 6.5 to 7.5 percent).

Adjusted free cash flow is expected to be around €0.6 billion to €1.0 billion (previously: around €0.7 billion to €1.1 billion).

Company :-PRHUB

User :- Lochan

Email :-lochan@prhub.com

Phone :-08022483008

Mobile:- 08022483008

Url :- https://www.prhub.com/

_(1)_thumb.jpg)

_(1)_(2)_thumb.jpg)